Topics

Mobile electronic POS systems—and this includes app solutions for beverage delivery must be operated in compliance with cash security regulations. Often underestimated in this regard is the legally compliant storage and transfer of data in the specific format required by the tax authorities. This usually requires an extension of the van sales software.

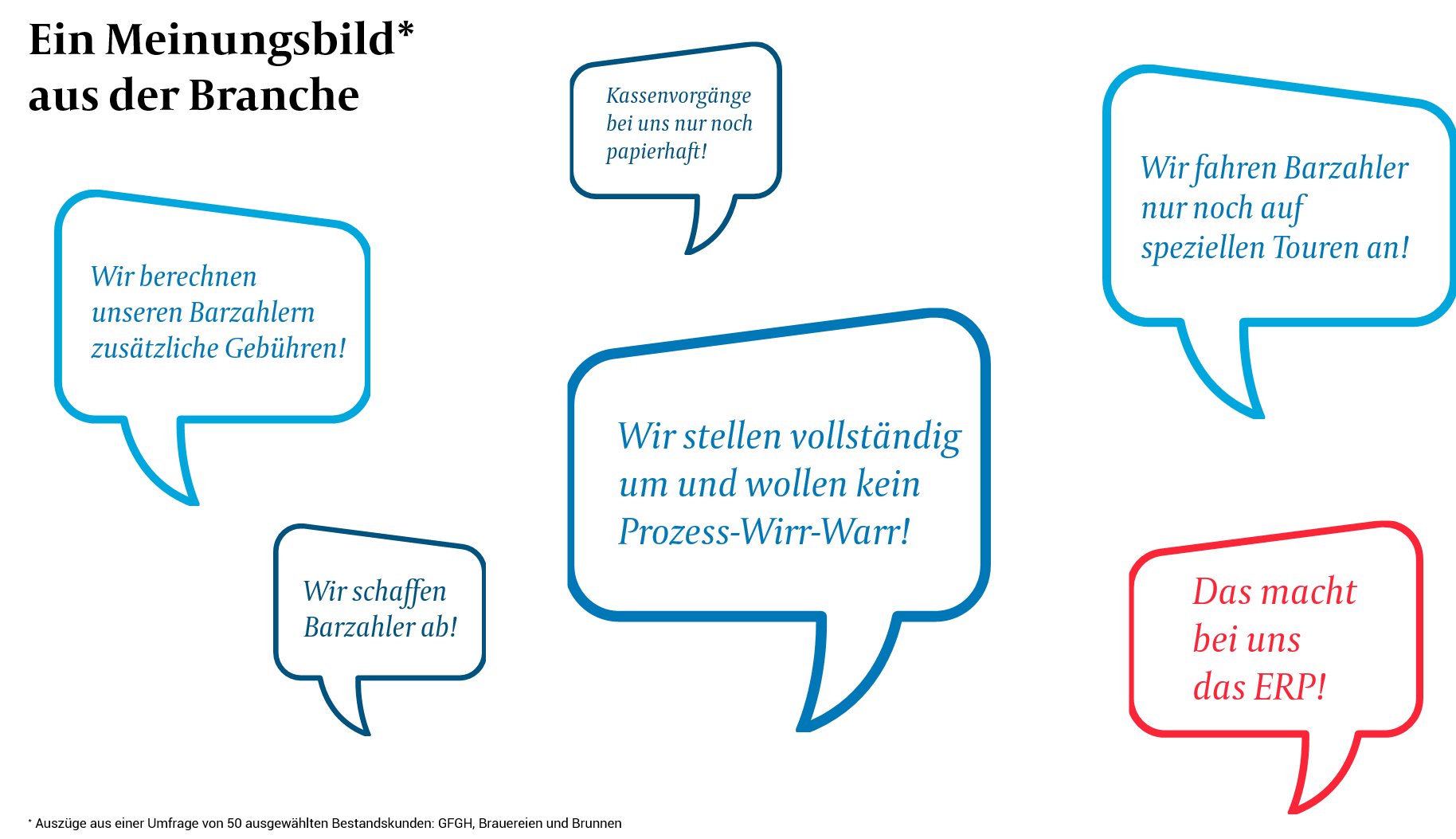

First, let's take a step back: Are you interested in basic information about the Cash Security Ordinance? In a separate article, we have compactly described the history and most important aspects of the Cash Security Ordinance, specifically in the context of beverage delivery with voluntary and mandatory cash payers. We show that cash security also applies in beverage logistics, in which cases it applies, and how you as a beverage logistician in a brewery or beverage wholesale business can handle the requirements.

Mobile Software in Van Sales

Cash payments have long been a critical focus for tax officials, and according to the Cash Security Ordinance (KassenSichV) and Section 146a of the Fiscal Code, cash payments are significantly more complex to handle. On the one hand, the technical recording of cash payments in POS systems is becoming more complex. In addition, POS operators must keep recorded business transactions in full for the legally prescribed retention period and be able to hand them over to the tax official in a detailed, specified data format during a cash inspection or tax audit.

Every company should expect a cash inspection!

— Andrea K%F6chling, Tax Officer

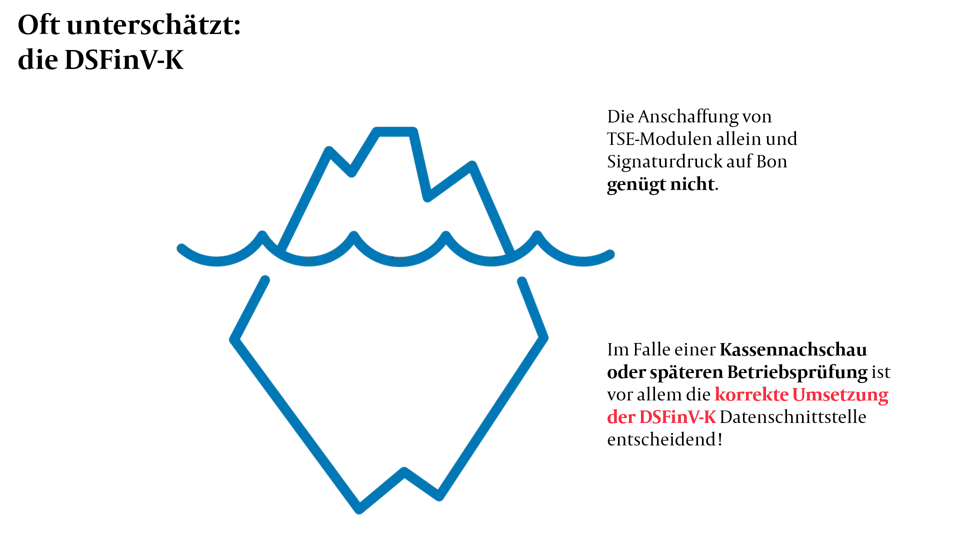

This is where mobile van sales or POS software comes into play. All information regarding payment transactions during a delivery tour converges here. It is obvious that the software must secure receipt and payment data via a separate TSE module (Technical Security Device) inserted into the mobile device, and the corresponding TSE information should then also be printed on the customer receipt or stored electronically. However, pure cash security using a TSE module alone is not sufficient. Correct data storage and transfer during an audit in the special DSFinV-K format is also required.

The Perspective of the Tax Authorities

Every company that operates electronic POS systems should expect a cash inspection. This is the tenor of Andrea Köchling, a Hamburg tax official who provides information on current tax administration topics as a speaker. The cash inspection is a classic scenario in which the mobile POS can come into the focus of the tax offices.

In such a context, operating manuals, the TSE certificate, the procedural documentation of the POS system, or technical information of the operated POS systems are checked. The auditor is allowed to order a cash check and have the cash balance counted. And—this is particularly important and, in our experience, largely underestimated in the context of van sales—the auditor is allowed to demand that POS data for an individually determined period be transferred in the so-called DSFinV-K format, for example, onto a data stick. This export capability should normally be provided by the mobile POS software.

Seamless Data Storage

When using a POS system, there is an obligation to preserve the electronically stored data or basic records seamlessly as mentioned in §3 of the Cash Security Ordinance. The retention obligation applies in particular to transaction data, TSE information, and any archived receipts. With regard to the usage scenario in van sales for the beverage industry, there is the challenge that permanent data storage on mobile devices is not possible or desired. Therefore, an alternative scenario is needed.

From the perspective of the POS system provider, it would be easiest if the basic records were stored in the ERP system. Theoretically, this is quite conceivable. In practice, however, there are considerable functional and technical challenges for both the ERP provider and the manufacturer of a mobile merchandise management system with a POS function.

In discussions with several providers of merchandise management systems for the beverage industry, including BSI-Software, Copa, Integria, Orga-Soft, or Team Business IT, it became clear that security can be implemented clearly limited to mobile recording. All data subject to recording obligations is present at the mobile level, and the leading ERP system is not involved in the cash payment process. The most practical way, according to commsult's experience, is to implement data storage at the level of the mobile POS. During a delivery or home service tour, all data is captured in compliance with cash security regulations, signed, and stored locally and permanently archived on a separate system after the tour is completed.

Why is the DSFinV-K So Important?

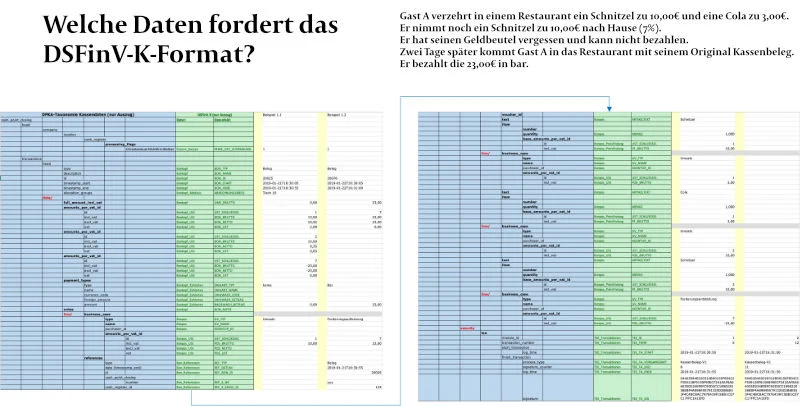

Now, the storage of application and log data that is complete and seamless from the perspective of the tax authorities is only the first step a software provider should cover to offer value to users. "The company must make the data available on a suitable data carrier in accordance with the conventions of the DSFinV-K," states the website of the Federal Central Tax Office under the keyword External Audits and DSFinV-K.

This brings us to a frequently underestimated aspect of the Cash Security Ordinance. Behind the bureaucratic abbreviation DSFinV-K lies the Digital Interface of the Financial Administration for Cash Register Systems. This interface is intended to simplify and accelerate external audits and cash inspections for both the auditor and the auditee, and to enable the uniform evaluation of POS data in the tax administration's software. Therefore, in the interface documentation, which comprises a good 120 pages, it is made unmistakably clear: "When auditing an electronic recording system [...] the data must be made available in the format of the DSFinV-K." And ultimately, the POS manufacturer or the manufacturer of the driver app in the context of beverage logistics must implement this requirement.

The audit software will generally perform a completeness check of the records. The prescribed records include not only the secured data but also information going beyond that. For the mobile POS system, this means proactively logging all information desired by tax officials during a tour, storing it permanently, and preparing it for DSFinV-K-compliant data export.

Usually, implementing these requirements will require a tailored extension of the mobile van sales software or mobile merchandise management system. This can be done, for example, through a software adaptation including an extension of the mobile van sales solution for the permanent storage of all DSFinV-K-relevant data. Additionally, the extension should enable DSFinV-K-compliant data export so that in the event of an emergency, i.e., a cash inspection by the tax office, the data requested by the auditor can be provided promptly.

The Next Cash Inspection is Sure to Come

Let's summarize once more: The Cash Security Ordinance prescribes the manipulation-proof signing of cash payments by a TSE in an electronic recording system. In addition, signed data and potentially further information must be stored for at least the period of the statutory retention period and must be available via a defined interface. With modern software, mobile security of cash payments and subsequent storage and export are possible. And you can face the next cash audit with peace of mind.